Seven Corners Travel Medical Insurance - 2025 Review

Seven Corners Travel Medical Insurance

8

Strengths

- Strong Insurance Partner

- Good Trip Cancellation Benefit

Weaknesses

- No Waiver for Pre-Existing Conditions

- Only For Non-US Travelers

Sharing is caring!

Seven Corners Travel Insurance: What is Travel Medical Insurance?

The Travel Medical Insurance is a customizable policy from Seven Corners Travel Insurance for NON-US residents for medical only coverage for travel outside their home country that does not include traveling to the USA. It does NOT provide coverage for trip cancellation and trip interruption but allows the traveler to customize the other plan benefits. Trips up to 364 days can be covered. If less than 364 days is purchased, the trip can be extended with a $5 fee for each extension until the total trip length maxes out at 364 days. There are two (2) versions of the policy – Basic and Choice.

Travel Medical Insurance Benefits

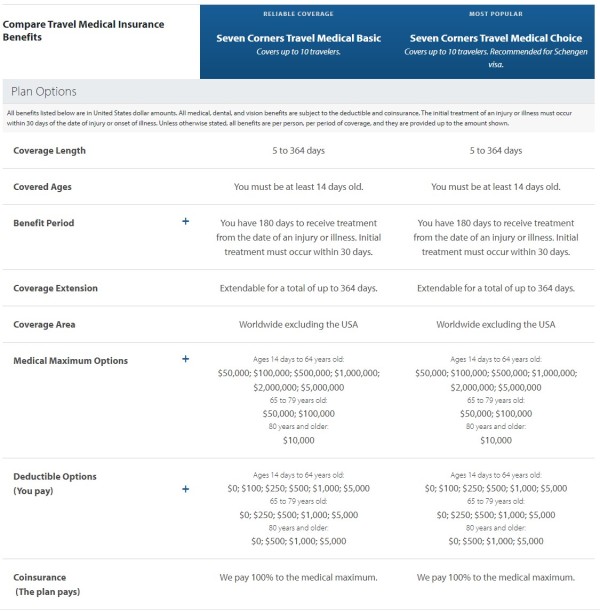

In the tables below the benefits for the Basic version of the policy are listed on the left and the benefits for the Choice version of the policy are listed on the right. Travelers from 14 days old can be covered.

Medical maximum coverage options available with either the Basic or Choice plan are based on age. For ages 14 days to 64 options are $50,000 up to $5 million. Ages 65-79 options are $50,000 or $100,000 and for ages 80+ the maximum is $10,000.

Deductible options are also age-based. For travelers 14 days to 64, the deductible options range from $0 - $5,000. While younger travelers have several lower priced deductible options such as $100 and $250, older travelers do not have these options available.

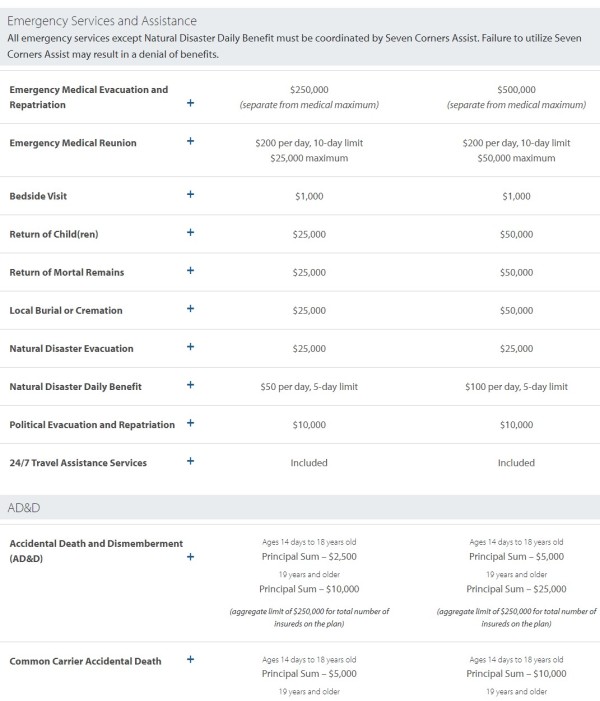

For benefits such as AD&D, the Choice plan offers higher amounts than the Basic plan – up to $5,000 for travelers aged 14 days to 18 and $25,000 for travelers over 18.

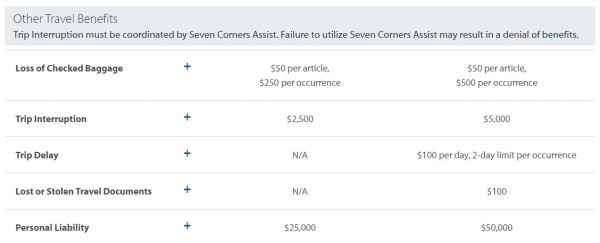

For additional benefits such as loss baggage, trip interruption and trip delay, again the Choice plan offers higher benefits than the Basic plan.

24/7 Travel Assistance Service - Included (provided by Seven Corners Assist)

The plans offer a directory of medical providers, medical assistance services and COVID-19 coverage up to the medical maximum selected.

Conclusion

For non-US travelers needing medical coverage while traveling outside their home country and not intending to travel in the US, this policy can be a good choice, The plans are customizable and reasonably priced.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Patricia rethemeie rcustomer

nadiyah was very helpfulpat

nadiyah was ver he lpfuly

Patricia Renzetti

Christiana explained the differences…

Christiana explained the differences between the policies very clearly and also assured us (my sister and I) what the meaning of pre-existing condition meant. It was a relief. She was extremely kind and courteous and patient. Also Don was helpful when I finally called to pay the fee. Thank you AARDY!

Deane Wolcott

Very satisfied customer

The Agent, Felicia (sp?) was friendly, knowledgeable, provided information clearly, was patient, and very efficient